In the realm of investment, the choice between shares and bonds is fundamental, marking the divide between ownership in a company and lending money to an entity with the expectation of future repayments. This distinction lies at the core of portfolio construction and investment strategy, influencing not only the potential returns an investor might expect but also the level of risk they are exposed to. Each instrument plays a pivotal role in the financial markets, offering diverse opportunities and challenges to investors.

Shares represent partial ownership in a company, entitling the shareholder to a proportion of the profits, known as dividends, and the potential for capital gains as the value of the company grows. Bonds, on the other hand, are essentially loans made by an investor to a borrower (typically corporate or governmental) that need to be repaid with interest by a certain date. They offer regular income through interest payments and are generally considered less risky than shares, although they typically offer lower returns.

The fundamental difference between shares and bonds rests in their inherent nature; shares offer a piece of ownership and a claim on future profits, while bonds provide a fixed income stream and a promise of principal repayment. This distinction influences the investor’s return on investment, risk exposure, and the role each instrument plays within a diversified investment portfolio. Understanding these differences is crucial for making informed decisions that align with one’s financial goals and risk tolerance.

Shares Basics

Definition

Shares, also known as stocks, represent ownership in a company. When you buy shares, you’re buying a piece of the company’s assets and earnings. Essentially, you become a shareholder and own a fraction of the company.

Types of Shares

There are mainly two types of shares:

Common Shares

- Ownership: Holders have a claim on the company’s profits and assets.

- Voting Rights: Each share typically grants the shareholder one vote at company meetings.

- Dividends: Payment is not guaranteed but depends on the company’s profitability.

Preferred Shares

- Fixed Dividends: These shares offer fixed dividend payments, making them similar to bonds.

- Priority: In case of liquidation, preferred shareholders are paid before common shareholders.

- Limited Voting Rights: Typically, these shares do not provide voting rights unless dividends are unpaid.

Benefits

Investing in shares offers several benefits:

- Potential for High Returns: Over time, shares can provide significant capital gains.

- Income through Dividends: Companies may distribute profits to shareholders in the form of dividends.

- Ownership and Voting Rights: Shareholders can influence company decisions through their voting rights.

Risks

However, investing in shares comes with risks:

- Market Volatility: Share prices fluctuate based on market conditions.

- Dividend Variability: Dividends are not guaranteed and can vary.

- Potential for Loss: Investors can lose their entire investment if a company fails.

Bonds Basics

Definition

Bonds are debt instruments. When you buy a bond, you’re lending money to an issuer (a government, municipality, or corporation) in exchange for periodic interest payments and the return of the bond’s face value at maturity.

Types of Bonds

There are several types of bonds:

Government Bonds

- Safety: Considered safe investments as they are backed by the government.

- Lower Returns: Typically offer lower interest rates compared to corporate bonds.

Corporate Bonds

- Higher Risk: Riskier than government bonds due to the potential for corporate default.

- Higher Returns: Generally offer higher interest rates to compensate for the increased risk.

Municipal Bonds

- Tax Advantages: Interest income is often exempt from federal taxes and, in some cases, state and local taxes.

- Variability in Risk: Risk levels vary depending on the municipality’s financial health.

Benefits

Bonds provide several benefits:

- Regular Income: Bonds pay interest regularly, providing a steady income stream.

- Return of Principal: The face value of the bond is repaid at maturity, assuming no default.

- Lower Risk: Generally considered less risky than stocks, especially government bonds.

Risks

Investing in bonds also involves risks:

- Credit Risk: The risk that the issuer will default and not pay back the principal or interest.

- Interest Rate Risk: As interest rates rise, bond prices typically fall.

- Inflation Risk: Inflation can erode the purchasing power of the interest payments.

Key Differences

Ownership and Rights

- Shares provide ownership in a company, including potential profits and voting rights.

- Bonds represent a loan from the investor to the issuer, without conveying ownership or voting rights.

Return on Investment

- Shares offer the potential for higher returns through capital gains and dividends but with higher risk.

- Bonds offer fixed income through interest payments, usually with lower risk and returns.

Risk Profile

- Shares carry a higher risk of loss but also the potential for significant gains.

- Bonds are seen as safer investments, especially government bonds, but with limited upside.

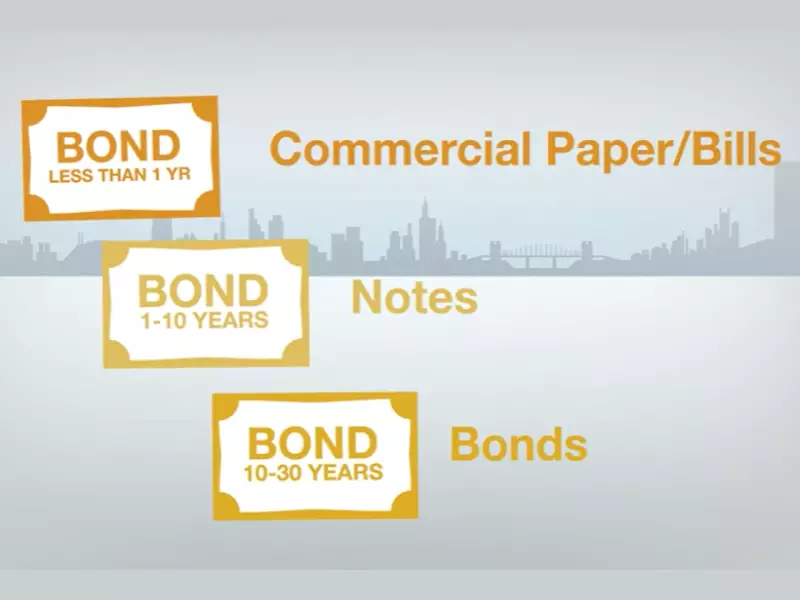

Duration and Maturity

- Shares can be held indefinitely, with no maturity date.

- Bonds have a fixed maturity date when the principal is repaid to the bondholder.

Voting Rights

- Shareholders have voting rights that allow them to influence company decisions.

- Bondholders do not have voting rights, as they are not owners of the company.

Investment Strategy

Portfolio Diversification

Diversification is key to reducing risk in your investment portfolio. It means spreading your investments across various asset classes, such as shares, bonds, real estate, and commodities. The idea is simple: when one market sector performs poorly, another might be doing well, balancing the overall performance of your portfolio. To achieve effective diversification:

- Invest in a mix of financial instruments.

- Consider geographical diversification by investing in international markets.

- Rebalance your portfolio regularly to maintain the desired asset allocation.

Risk Tolerance

Understanding your risk tolerance is critical to forming an investment strategy that aligns with your comfort level. Risk tolerance varies among investors and depends on factors such as age, investment experience, financial situation, and the investment horizon. Identifying your risk tolerance helps in selecting the right mix of investments. For instance, those with a low risk tolerance may prefer bonds or high-grade fixed-income securities, while those with a high risk tolerance might opt for stocks or real estate investments.

Investment Horizon

Your investment horizon is the expected time period you plan to hold an investment before taking your money out. It significantly influences your investment choices and strategy. Generally:

- Short-term horizons are suitable for less volatile investments like money market funds or short-term bonds.

- Long-term horizons allow investors to ride out market volatility and benefit from the potentially higher returns of stocks.

Market Factors

Interest Rates Impact

Interest rates have a profound effect on the investment landscape. When interest rates rise:

- Bond prices typically fall, negatively affecting existing bond investments.

- Stocks might also decline, as higher rates increase borrowing costs for companies and can dampen economic growth.

Conversely, when interest rates drop:

- Bond prices increase.

- Stocks may benefit from lower borrowing costs and stimulated economic growth.

Economic Conditions

The overall economic health influences investment returns. In a robust economy:

- Companies tend to perform well, potentially leading to higher stock prices.

- Bonds might face downward pressure on prices if interest rates rise in response to economic growth.

During economic downturns:

- Stocks may suffer due to reduced earnings.

- Certain bonds, especially government bonds, might perform better as investors seek safer assets.

Market Volatility

Market volatility refers to the degree of variation in the price of an investment over time. High volatility means the price can change dramatically over a short period, while low volatility indicates smaller price changes. Understanding and preparing for volatility is crucial in managing investment risk and making informed decisions.

Decision Making

Financial Goals

Setting clear financial goals is the foundation of a successful investment strategy. Goals can range from short-term objectives like saving for a vacation to long-term plans like retirement savings. Defining your goals helps in:

- Choosing the right investment vehicles.

- Determining the required risk level and investment horizon.

- Tracking progress and making adjustments as needed.

Market Analysis

Conducting market analysis is essential for informed investment decisions. It involves examining market trends, economic indicators, and financial statements to predict future movements. Tools for market analysis include:

- Fundamental analysis, focusing on company performance and economic conditions.

- Technical analysis, examining price movements and trading volumes to identify patterns.

Advisor Consultation

For many investors, consulting with a financial advisor can provide valuable insights and guidance. Advisors can help in:

- Assessing your financial situation and goals.

- Building a diversified investment portfolio.

- Offering advice on tax implications and retirement planning.

Case Studies

Successful Investment

A successful investment case study might involve an investor who achieved substantial returns through a well-diversified portfolio. Key factors in their success could include:

- Early investment in a mix of stocks and bonds.

- Regular portfolio rebalancing to maintain an optimal asset allocation.

- Long-term investment horizon, allowing them to benefit from compounding returns.

Risk Management

A case study on risk management might detail how an investor protected their portfolio from significant losses during a market downturn. Strategies used could involve:

- Setting stop-loss orders to limit potential losses.

- Using options for hedging against market declines.

- Diversifying investments across asset classes and geographic regions to mitigate risk.

Frequently Asked Questions

What determines the price of shares and bonds?

The price of shares is influenced by a myriad of factors including company performance, investor sentiment, market conditions, and economic indicators. Bonds’ prices, on the other hand, are chiefly affected by interest rate movements, credit quality of the issuer, and the bond’s time to maturity. Both are subject to supply and demand dynamics in the market.

How do interest rates affect bonds and shares?

Interest rates have a direct impact on bond prices; as rates rise, bond prices typically fall, and vice versa. This inverse relationship stems from the fixed interest payments bonds offer, becoming less attractive as rates increase. Shares can also be affected by interest rates, as higher rates may reduce consumer spending and corporate profitability, potentially leading to lower stock prices.

Can you lose money in bonds?

Yes, it is possible to lose money in bonds if the issuer defaults on payments or if the bond is sold before maturity at a price lower than the purchase price. Additionally, inflation can erode the purchasing power of the bond’s fixed payments, leading to a real loss of value over time.

Why diversify between shares and bonds?

Diversifying between shares and bonds can help manage risk and volatility in an investment portfolio. Shares offer the potential for higher returns but come with greater volatility and risk, while bonds provide more stable, albeit typically lower, returns. A mix of both can achieve a balance between risk and reward based on individual investment goals and risk tolerance.

Conclusion

In navigating the investment landscape, understanding the distinct characteristics and roles of shares and bonds is indispensable. This knowledge empowers investors to craft portfolios that not only align with their financial objectives but also match their risk appetite. The judicious selection and balance between these two fundamental investment types can pave the way for a robust and resilient investment strategy.

The decision to invest in shares or bonds—or a blend of both—ultimately hinges on individual goals, time horizon, and risk tolerance. As the financial markets evolve, so too should investors’ strategies, always informed by a clear understanding of the foundational elements of investing. In this dynamic arena, knowledge remains the most valuable asset, guiding decisions towards achieving financial aspirations.