In the complex world of business finance, distinguishing between various types of income is crucial for a comprehensive understanding of a company’s financial health. Income, in its broadest sense, represents the money that a business brings in from its activities. However, not all income is created equal, and differentiating between these types can offer valuable insights into the operations and financial stability of a business.

The distinction between operating and nonoperating income lies in their sources and implications for a company’s financial performance. Operating income, also known as operating profit, stems from a company’s core business activities. In contrast, nonoperating income is derived from secondary activities, such as investments, asset sales, or interest income. This fundamental difference highlights the varying nature of income streams and their impact on assessing a company’s operational efficiency and profitability.

Understanding these distinctions is not just an accounting exercise; it plays a pivotal role in strategic decision-making, investment analysis, and financial reporting. Operating income provides a clear picture of a business’s operational health and efficiency, while nonoperating income offers insights into its financial strategy and risk management. Together, they form a comprehensive view of a company’s financial ecosystem, enabling stakeholders to make informed decisions.

Core Concepts

Operating Income

Definition and Examples

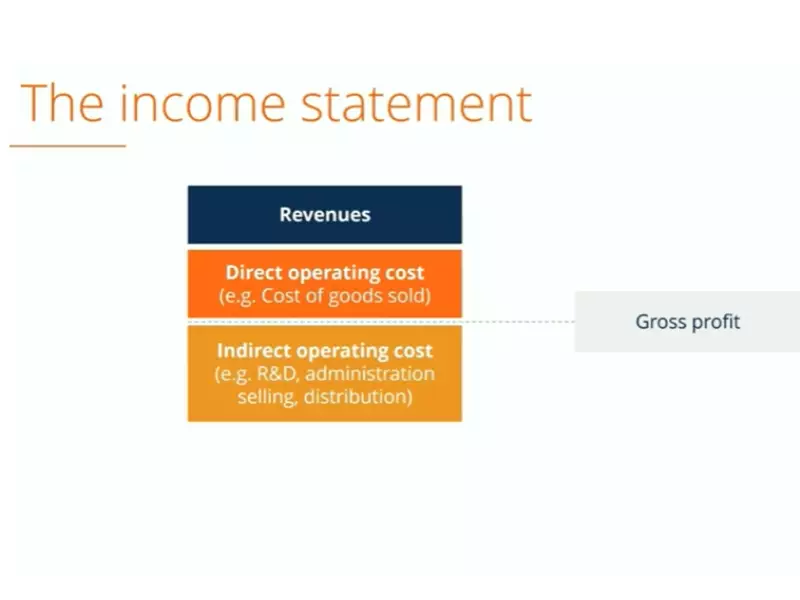

Operating income, also known as operating profit or earnings before interest and taxes (EBIT), is a key financial metric that measures a company’s profit from its core business activities. This figure excludes any earnings from non-core operations, such as investments or one-time gains. Examples of operating income sources include revenue from sales of goods and services, less the cost of goods sold (COGS) and operating expenses like rent, utilities, and salaries.

Calculation Methods

To calculate operating income, follow these steps:

- Start with gross revenue: This is the total income from all sales of goods and services.

- Subtract COGS: COGS includes direct costs attributable to the production of the goods sold by a company.

- Subtract operating expenses: These are expenses required for the day-to-day functioning of the business, excluding interest or tax payments.

The formula looks like this:

javaCopy code

Operating Income = Gross Revenue - COGS - Operating Expenses

Impact on Business Evaluation

Operating income is a crucial indicator of a company’s financial health and operational efficiency. A high operating income suggests that a company is proficient at managing its core business activities, which is a positive sign for investors and analysts. This metric is often used to compare companies within the same industry, providing insight into competitive positioning and operational effectiveness.

Nonoperating Income

Definition and Examples

Nonoperating income refers to earnings from activities not related to a company’s core business operations. This can include interest income, dividends from investments, gains from the sale of assets, or income from lawsuits. For instance, if a software company invests in real estate and earns rental income, this would be considered nonoperating income.

Sources and Variability

The sources of nonoperating income can be diverse and unpredictable, including:

- Investment income: Dividends or interest earned from financial investments.

- Asset sales: Profits from selling assets not used in the company’s primary operations.

- Foreign exchange gains: Profits from currency exchange rate fluctuations.

Due to its nature, nonoperating income can be highly variable, impacting the predictability of a company’s total income.

Role in Financial Analysis

Nonoperating income plays a critical role in financial analysis, offering insights into a company’s financial strategy and risk management. Analysts use this information to assess the sustainability of a company’s earnings and its ability to generate income outside of its primary business operations.

Comparison

Key Differences

The key differences between operating and nonoperating income lie in their nature and sources. Operating income arises from a company’s primary business activities, while nonoperating income comes from secondary sources. This distinction is vital for accurate financial reporting and analysis.

Nature and Sources

- Operating income: Generated from core business operations.

- Nonoperating income: Comes from non-core activities and investments.

Financial Reporting Implications

Accurate distinction between these income types is crucial for financial reporting. It ensures transparency and provides stakeholders with a clear understanding of where a company’s income is coming from, aiding in more informed decision-making.

Taxation Considerations

Taxation rules may differ for operating and nonoperating income. Operating income is typically subject to standard corporate tax rates, while nonoperating income can be taxed differently depending on the source, such as capital gains tax on the sale of assets.

Analysis Techniques

EBIT and EBITDA Overview

EBIT (Earnings Before Interest and Taxes) and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) are two important metrics used in financial analysis to measure a company’s operational profitability without the effect of non-operating decisions, like financing or accounting methods. EBITDA further removes depreciation and amortization expenses to provide a clearer picture of operating performance.

Adjustments for Nonoperating Items

When analyzing a company’s financial health, it’s important to adjust for nonoperating items to get a true sense of operational efficiency. This involves:

- Identifying nonoperating income and expenses: Carefully review financial statements to separate these items.

- Adjusting financial metrics: Recalculate metrics like EBIT and EBITDA after removing nonoperating items.

Use in Investment Decisions

Understanding the distinction between operating and nonoperating income is crucial for investment decisions. Investors look for companies with strong operating income as a sign of sustainable business operations. However, nonoperating income can also indicate strategic financial management and additional income streams, which might be attractive depending on the investor’s strategy.

Strategic Importance

For Business Strategy

Operating Margin as Performance Indicator

The operating margin is a critical performance indicator that measures a company’s efficiency at its core operations. It is calculated by dividing operating income by net sales. A higher operating margin indicates a more profitable and efficiently run company, reflecting its ability to generate income from its primary business activities. For businesses, maintaining a strong operating margin is essential for long-term sustainability and competitiveness. It signals to stakeholders that the company is proficient in managing its resources and controlling costs related to its core operations.

Nonoperating Income in Diversification

Nonoperating income can play a significant role in a company’s diversification strategy. By generating income from sources outside of its primary business activities, a company can reduce its reliance on its core operations for profitability. This diversification of income sources can help stabilize overall income, especially during periods when the core business is underperforming. For instance, investment income or profits from asset sales can provide a financial cushion, allowing the company to navigate through challenging market conditions more effectively.

For Investors

Assessing Financial Health

Investors rely on a thorough assessment of a company’s financial health before making investment decisions. Operating income, as a measure of a company’s efficiency in its core operations, and nonoperating income, indicating the company’s strategic financial management and diversification, are both critical components of this assessment. A balanced mix of both, with a strong emphasis on sustainable operating income, is often seen as a sign of a healthy, well-managed company.

Risk Assessment and Portfolio Strategy

For investors, understanding the sources and stability of a company’s income is essential for risk assessment and crafting a portfolio strategy. Operating income stability suggests a lower risk associated with the company’s core business operations, whereas nonoperating income can introduce variability and potentially higher risk. Investors may look for companies with a strong operating income as a safer bet, while also considering the strategic advantages of nonoperating income in terms of potential high returns from investments or asset sales.

Challenges and Considerations

Volatility and Sustainability

Predicting Nonoperating Income

Predicting nonoperating income can be challenging due to its inherent volatility. Factors such as market fluctuations, interest rate changes, and the unpredictable nature of asset sales can significantly impact nonoperating income from year to year. This unpredictability makes it difficult for companies to rely on nonoperating income as a consistent source of earnings, emphasizing the importance of a strong operating income for sustainable financial health.

Operating Income Stability

Stability in operating income is crucial for a company’s long-term success. It indicates consistent performance in the company’s core business activities, making it a reliable indicator of financial health. However, maintaining this stability requires effective management of operating costs and the ability to adapt to changing market conditions. Companies must continuously innovate and improve operational efficiencies to sustain and enhance their operating income.

Accounting Practices

Recognizing Income

The process of recognizing income is governed by accounting principles, which ensure that income is recorded in the correct accounting period. Operating income should reflect earnings from the company’s primary business operations, while nonoperating income includes earnings from secondary activities. Proper income recognition is crucial for accurate financial reporting and analysis, allowing stakeholders to make informed decisions based on the company’s operational performance and financial strategies.

International Variations

Accounting practices for recognizing operating and nonoperating income can vary internationally due to differences in accounting standards and regulations. For example, what qualifies as operating income in one jurisdiction may be classified differently in another. These variations can complicate the process of comparing companies across different countries. Understanding these international differences is essential for investors and analysts who operate in the global market, ensuring accurate and comparable financial analysis across borders.

Frequently Asked Questions

What is Operating Income?

Operating income refers to the profit a company generates from its core business activities, excluding any earnings from investments, interest, or other non-core business operations. It reflects the company’s operational efficiency and its ability to generate profit through its primary business.

How is Nonoperating Income Different?

Nonoperating income arises from activities not directly related to a company’s core business operations, such as investments, interest income, or gains from asset sales. It can be less predictable and may vary significantly from year to year, reflecting the company’s financial strategy rather than its operational performance.

Why is Distinguishing Between These Incomes Important?

Distinguishing between operating and nonoperating income is essential for accurately assessing a company’s financial health and operational efficiency. It helps investors and analysts understand where a company’s earnings are coming from and gauge its long-term sustainability and profitability.

Can Nonoperating Income Affect a Company’s Valuation?

Yes, nonoperating income can affect a company’s valuation, especially if it represents a significant portion of the company’s total income. Investors may adjust their valuation models to reflect the sustainability and predictability of these income streams.

Conclusion

Understanding the distinction between operating and nonoperating income is fundamental for anyone involved in analyzing or managing business finances. It provides a clearer lens through which the financial health and operational efficiency of a company can be assessed. Operating income offers insight into the profitability of core business activities, while nonoperating income reveals the effects of strategic financial decisions and external factors on a company’s earnings.

This nuanced understanding allows stakeholders to make more informed decisions, whether in investment, strategic planning, or financial analysis. Recognizing the different nature and implications of these income types underscores the complexity of business operations and the importance of a comprehensive financial analysis for sustainable success.