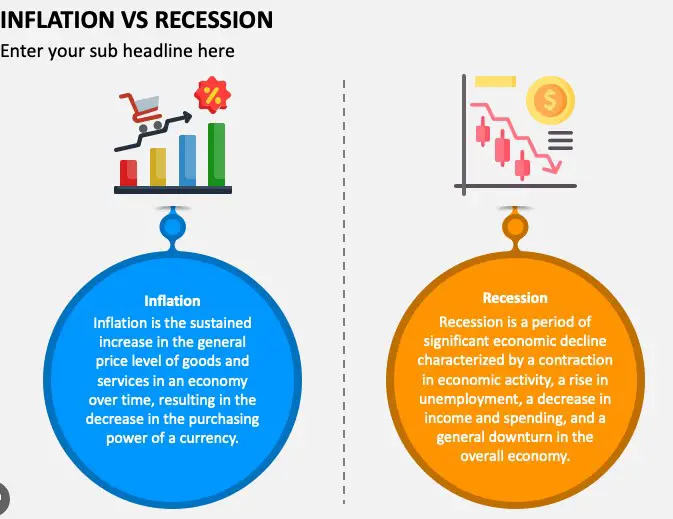

Economic cycles are a fundamental aspect of market economies, characterized by alternating periods of expansion and contraction. Among these phases, recession and inflation stand out due to their significant impact on the economy and the well-being of individuals. Recession refers to a period of temporary economic decline during which trade and industrial activities are reduced, often identified by a fall in GDP in two successive quarters. Inflation, on the other hand, is the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling.

The relationship between recession and inflation is intricate and has long been the subject of economic study. While inflation involves an increase in prices, a recession is marked by a slowdown in economic activities. However, these phenomena can coexist, leading to a situation known as stagflation, which combines stagnant economic growth with high inflation rates. Understanding the dynamics between recession and inflation is crucial for policymakers, businesses, and individuals to make informed decisions.

Recession and inflation affect various aspects of the economy, including employment rates, consumer purchasing power, and investment returns. These economic indicators not only influence national economic policy but also have direct implications on everyday life. From the prices of groceries to the stability of jobs, the interplay between recession and inflation shapes the economic landscape in which we live.

Recession Explained

Definition and Characteristics

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, typically visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. Key characteristics of a recession include:

- Increased unemployment: As companies earn less revenue, layoffs increase.

- Reduced consumer spending: Uncertainty leads to decreased spending on non-essential goods and services.

- Lower production: Businesses scale back production in response to reduced demand.

Causes of a Recession

Recessions can be triggered by several factors, including:

- High interest rates: Reduces consumer borrowing and spending.

- Reduced consumer confidence: Leads to decreased spending.

- Falling demand: Results in overproduction and layoffs.

- Financial crises: Disrupts lending, leading to bankruptcies and reduced investment.

Inflation Unpacked

Definition and Types

Inflation is the rate at which the general level of prices for goods and services is rising, eroding purchasing power. There are several types of inflation:

- Cost-push inflation: When production costs rise, businesses pass these costs onto consumers.

- Demand-pull inflation: Occurs when demand for goods and services exceeds supply.

- Built-in inflation: Arises from the expectation of future inflation, affecting wage negotiations.

Causes of Inflation

Inflation can stem from various sources, including:

- Increased production costs: Raw materials or wages.

- Higher demand: Often from increased consumer spending or government expenditure.

- Monetary policy: Central banks’ actions can influence inflation rates.

Economic Theories Linking Recession and Inflation

Keynesian Perspective

Keynesian economists argue that demand-side factors primarily drive economic cycles. They believe that:

- In times of recession, government intervention can stimulate demand through fiscal policy, such as spending and tax cuts.

- Inflation occurs when demand outstrips supply, suggesting that careful management of fiscal policy can mitigate inflationary pressures.

Monetarist Viewpoint

Monetarists, following Milton Friedman, contend that the money supply’s growth rate is the main cause of inflation. They posit:

- A steady increase in the money supply aligns with natural economic growth, preventing inflation.

- Recessions occur due to mismanagement of the money supply, advocating for monetary policy as the tool for economic stabilization.

Supply-side Economics

Supply-side economists focus on how production and supply factors influence economic health. They believe:

- Reducing taxes and regulations stimulates business investment, increases production, and combats recession.

- Efficient markets naturally adjust to correct imbalances, reducing the likelihood of prolonged inflation or recession.

Historical Instances

Economic history provides numerous instances of recessions and inflations, from which valuable lessons have been learned.

Case Studies of Past Recessions and Inflation

- The Great Depression (1930s): A severe global economic downturn, teaching the importance of monetary flexibility and fiscal stimulus.

- Stagflation (1970s): High inflation combined with high unemployment, highlighting the limitations of traditional monetary policy.

Lessons Learned from History

- Active fiscal policy: Key in combating recessions.

- Monetary policy’s role: Crucial in managing inflation expectations.

- Diversification: Important for economic resilience.

Impact on Society

Effects on Employment and Wages

- Unemployment rises during recessions, impacting family income and consumer confidence.

- Wage stagnation or decline: Often accompanies increased inflation, eroding real income.

Influence on Consumer Behavior

- Increased saving: During recessions, fear of unemployment prompts higher savings rates.

- Reduced spending: High inflation erodes purchasing power, leading to more cautious spending.

Consequences for Businesses

- Reduced profits: Both recession and inflation can squeeze profit margins.

- Operational adjustments: Businesses may need to cut costs, adjust pricing strategies, or innovate to survive challenging economic conditions.

Global Perspectives

Recession and Inflation in Developed vs. Developing Countries

Economic challenges like recession and inflation do not impact all countries equally. Developed countries, with their more resilient economic structures, often have better mechanisms to withstand economic downturns. These nations usually possess stronger financial institutions, more significant reserves, and better access to credit, which can help mitigate the effects of a recession. On the inflation front, developed countries typically experience lower and more stable rates due to their advanced monetary policies and central bank independence.

Developing countries, on the other hand, may face harsher realities. Their economies are generally more volatile, and they often lack the financial infrastructure to effectively manage economic downturns. Inflation can hit harder in these regions due to less stable monetary policies and factors such as food price shocks, which disproportionately affect lower-income families.

Case Study: The Global Financial Crisis

The Global Financial Crisis (GFC) of 2007-2008 serves as a prime example of how recessions and inflation can impact the global economy. Originating in the United States’ housing market, the crisis quickly spread worldwide, demonstrating how interconnected modern economies are. The GFC led to significant economic downturns in numerous countries, unemployment spikes, and a sharp increase in government debt due to bailout and stimulus measures.

Policy Responses

Central Bank Strategies

Central banks play a crucial role in managing economic stability. During recessions, they may employ strategies such as:

- Lowering interest rates to encourage borrowing and spending.

- Quantitative easing to increase the money supply and stimulate economic activity.

In periods of high inflation, central banks might:

- Increase interest rates to curb spending and borrowing.

- Tighten monetary policy to reduce the money supply.

Government Fiscal Policies

Governments can also respond with fiscal policies, including:

- Stimulus spending to boost economic activity during recessions.

- Austerity measures to control inflation by reducing government spending and debt.

International Cooperation and Solutions

International cooperation is vital for addressing global economic challenges. Organizations like the International Monetary Fund (IMF) and the World Bank provide financial assistance and advice to countries struggling with recessions or inflation. Global forums such as the G20 facilitate discussions on coordinated policy responses to ensure stability in the global economy.

Predicting Future Trends

Economic Indicators to Watch

Predicting future economic trends involves monitoring various indicators, including:

- GDP growth rates: Indicative of overall economic health.

- Unemployment rates: Higher rates may signal a recession.

- Inflation rates: Rising rates can indicate overheating economies.

- Consumer confidence: Reflects consumer sentiment and spending intentions.

Expert Opinions and Analysis

Economic forecasts rely on expert analysis, which considers current data, historical trends, and potential future events. Economists use models to predict how different factors might influence the global economy, helping policymakers, businesses, and individuals make informed decisions.

Managing Personal Finances

During times of economic uncertainty, managing personal finances becomes even more critical.

Tips for Individuals During Inflation and Recession

- Budget wisely: Track spending and prioritize essentials.

- Build an emergency fund: Aim for savings that cover 3-6 months of expenses.

- Reduce debt: Especially high-interest debt, to improve financial resilience.

Investment Strategies

Diversifying investments can help protect against economic fluctuations. Consider:

- Bonds: Tend to be safer during recessions.

- Stocks: Can offer growth during recovery phases.

- Real estate: Often serves as a hedge against inflation.

Frequently Asked Questions

What Causes a Recession?

Recessions are typically triggered by various factors, including a significant decrease in spending by households and businesses, financial crises, or unexpected economic shocks. Government policies, such as interest rate adjustments and fiscal austerity, can also play a role in precipitating a recession.

How Does Inflation Affect the Economy?

Inflation reduces the purchasing power of money, meaning consumers can buy less with the same amount of money. This can lead to slower economic growth as individuals and businesses cut back on spending. However, moderate inflation is often seen as a sign of a healthy economy, as it indicates growing demand.

Can Recession and Inflation Happen at the Same Time?

Yes, recession and inflation can occur simultaneously, a situation known as stagflation. Stagflation presents a unique challenge as it combines the negative aspects of both phenomena, leading to high unemployment, stagnant economic growth, and rising prices.

How Can Individuals Protect Their Finances During Inflation and Recession?

Individuals can safeguard their finances by diversifying their investment portfolio, focusing on sectors less impacted by economic downturns, and maintaining a solid emergency fund. Additionally, considering long-term investments and staying informed about economic trends can help navigate uncertain times.

Conclusion

The intricate dance between recession and inflation is a testament to the complex nature of economic systems. While these phenomena can challenge economies and individuals alike, understanding their relationship provides valuable insights into navigating economic cycles. As the global economy continues to evolve, staying informed and adaptable will be key to weathering the storms of recession and inflation.

Recognizing the significance of economic literacy in this context cannot be overstated. For individuals, businesses, and policymakers, knowledge of how recession and inflation interact forms the foundation for strategic decision-making and future planning. As we look toward the future, embracing this knowledge will be crucial in fostering resilience and prosperity in an ever-changing economic landscape.