Financial statements serve as the backbone of a company’s financial information, showcasing its performance, financial position, and cash flows over a specific period. These documents are crucial for investors, management, and stakeholders to make informed decisions. Each statement, while powerful on its own, is part of a larger financial narrative that can only be understood fully when considered together.

The relationship between the balance sheet, income statement, and cash flow statement lies at the heart of financial analysis and decision-making. The balance sheet provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. The income statement, on the other hand, shows the company’s revenues, expenses, and profits over a period. The cash flow statement bridges these two by detailing the cash inflows and outflows, highlighting how the company’s operations, financing activities, and investments affect its cash position.

Understanding the interplay between these statements reveals the financial health and operational efficiency of a business. It allows stakeholders to assess profitability, liquidity, solvency, and investment potential. By analyzing how the statements connect, one can uncover insights into working capital management, asset utilization, and the sustainability of growth strategies. This comprehension is invaluable for anyone looking to delve into the financial dynamics of a company.

Financial Statement Basics

Types of Financial Statements

Balance Sheet

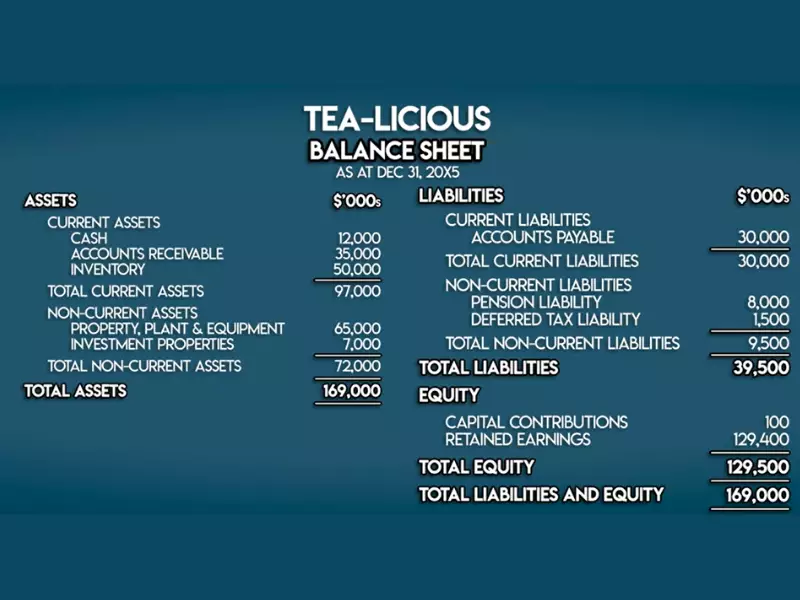

The Balance Sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It lists the company’s assets, liabilities, and shareholders’ equity. The fundamental equation underlying the balance sheet is:

Assets = Liabilities + Shareholders’ Equity

This equation shows that a company pays for what it owns (assets) by borrowing money (liabilities) or by taking it from investors (shareholders’ equity).

Income Statement

The Income Statement, also known as the Profit and Loss Statement, outlines the company’s revenues and expenses over a specific period. This statement highlights the company’s operational efficiency by detailing how revenue is transformed into net income. The key components include:

- Revenue

- Cost of Goods Sold (COGS)

- Gross Profit

- Operating Expenses

- Net Income

Cash Flow Statement

The Cash Flow Statement tracks the flow of cash in and out of a business over a period. It is crucial for assessing a company’s liquidity, operational efficiency, and financial flexibility. The statement is divided into three parts:

- Cash from Operating Activities

- Cash from Investing Activities

- Cash from Financing Activities

Purpose of Each Statement

The purpose of these financial statements is to provide stakeholders with detailed information about a company’s financial status and performance. Each statement serves a unique role:

- Balance Sheet: Offers a snapshot of financial position at a certain date.

- Income Statement: Shows how revenue is turned into net income over a period.

- Cash Flow Statement: Details how cash is generated and used during a period.

Interconnections Explained

Balance Sheet and Income Statement

How profits impact equity

Profits, or net income from the income statement, directly impact shareholders’ equity on the balance sheet. When a company earns a profit, it has a choice: reinvest in the business or distribute to shareholders. Reinvested profits increase the retained earnings component of shareholders’ equity.

Depreciation and its effects

Depreciation is an expense recorded on the income statement, reflecting the consumption of assets over time. It reduces net income but also decreases the book value of assets on the balance sheet, impacting equity.

Income Statement and Cash Flow

Operating activities’ impact

The net income from the income statement is the starting point for the cash from operating activities section of the cash flow statement. Adjustments are made for non-cash items (like depreciation) and changes in working capital, which indicates the cash generated or used in core business operations.

Non-cash expenses

Non-cash expenses such as depreciation and amortization are added back to net income in the cash flow statement. While these expenses reduce profit, they do not involve an actual cash outlay, thus adjusted to reflect true cash flow.

Cash Flow and Balance Sheet

Financing activities’ influence

Financing activities include borrowing, repaying debt, issuing stock, and paying dividends. These activities cause direct changes to liabilities and equity on the balance sheet, reflecting how financing operations impact the company’s financial structure.

Investment activities and asset changes

Investing activities typically involve purchasing or selling long-term assets and investments. These activities affect the asset side of the balance sheet, indicating how a company allocates its resources to support future growth.

Analyzing the Links

Working Capital Analysis

Current assets and liabilities

Working capital analysis examines the relationship between current assets and liabilities. It highlights a company’s ability to meet its short-term obligations with its short-term assets. An optimal level of working capital supports operational efficiency and financial health.

Profitability and Cash Flow

Revenue growth vs. cash generation

While an income statement can show a company growing its revenue, the cash flow statement reveals whether this growth translates into actual cash. This distinction is crucial for understanding a company’s true financial health and its ability to sustain operations and grow.

Asset Management

Long-term investments and depreciation

Effective asset management involves not just acquiring assets but also managing their depreciation and replacement. Depreciation affects both the income statement and balance sheet and must be strategically managed to support the company’s long-term financial health.

Strategic Decision Making

Financial Health Indicators

Ratios and metrics

To gauge a company’s financial health, analysts rely on a set of ratios and metrics that provide insights into various aspects of business performance. These include liquidity ratios (like the current ratio and quick ratio), profitability ratios (such as gross profit margin, net profit margin, and return on equity), and leverage ratios (debt-to-equity ratio, for example). Each ratio serves a specific purpose, offering a snapshot of financial stability, operational efficiency, and the company’s ability to meet its short-term and long-term obligations.

Forecasting and Planning

Using relationships for future projections

Forecasting and planning are critical components of strategic decision-making, enabling companies to set realistic goals and prepare for future challenges. Financial statements play a vital role here, as past and present financial data help predict future performance. For example, by analyzing trends in revenue growth, cash flow stability, and expense management, businesses can develop informed forecasts that drive strategic planning and investment decisions.

Risk Management

Identifying financial vulnerabilities

Risk management involves identifying and mitigating potential threats to a company’s financial health. This includes analyzing financial statements to uncover vulnerabilities such as high levels of debt, insufficient cash flow, or poor asset management. By understanding these risks, companies can develop strategies to strengthen their financial position, such as reducing unnecessary expenses, improving operational efficiency, or restructuring debt.

Practical Applications

Case Studies

Real-world examples of analysis

To illustrate the practical applications of financial statement analysis, consider the case of a company that successfully turned around its financial situation by closely examining its financial statements. By identifying a consistent decrease in cash flow from operations, the company implemented cost-cutting measures, optimized its inventory management, and renegotiated terms with suppliers, resulting in improved liquidity and profitability. Such real-world examples demonstrate the power of financial analysis in driving strategic decisions.

Tools and Techniques

Software and methodologies for analysis

In today’s digital age, a variety of software and methodologies are available to simplify and enhance the analysis of financial statements. Tools like QuickBooks, Xero, and SAP provide comprehensive financial management solutions, enabling businesses to monitor their financial health in real-time. Additionally, methodologies such as the DuPont analysis break down return on equity into its component parts, providing deeper insights into profitability, efficiency, and leverage factors influencing a company’s return on investment.

Frequently Asked Questions

How do financial statements interact with each other?

Financial statements are interconnected in several ways. The net income from the income statement affects both the balance sheet’s equity section and the cash flow from operating activities in the cash flow statement. Changes in balance sheet accounts, like inventory or accounts receivable, can also impact the cash flow statement’s sections on operations and investments. This integrated framework provides a comprehensive view of a company’s financial health.

Why is the cash flow statement important?

The cash flow statement is vital because it provides insights into a company’s liquidity, revealing how well it generates cash to meet debt obligations, fund operations, and make investments. Unlike the income statement, it accounts for cash activities, offering a clearer picture of financial stability and the company’s ability to sustain growth through its operational effectiveness and financing strategies.

How can analyzing the relationship between financial statements help in making investment decisions?

Analyzing the relationship between financial statements helps investors understand a company’s financial health, operational efficiency, and growth potential. By examining how changes in one statement affect the others, investors can assess profitability, liquidity, and solvency, which are crucial for making informed investment decisions. This analysis can reveal trends and predict future performance, guiding investment strategies.

Conclusion

The intricate relationship between the balance sheet, income statement, and cash flow statement forms the cornerstone of financial analysis. By examining how these statements interact, stakeholders can gain a deep understanding of a company’s financial health, operational efficiency, and future prospects. This knowledge is not just academic; it’s a practical tool for making informed decisions, whether for investment, management, or strategic planning purposes.

In the realm of finance, the synergy among these financial statements highlights the importance of a holistic approach to financial analysis. Stakeholders equipped with this comprehensive insight are better positioned to navigate the complexities of financial decision-making, ensuring a more informed and strategic approach to achieving financial goals and sustaining growth.