In the realm of finance, two terms frequently encountered by investors and borrowers alike are the coupon rate and the interest rate. While both concepts play a critical role in the financial markets, their application and implications differ significantly. Understanding these differences is essential for making informed investment decisions and managing financial products effectively.

The coupon rate is the annual interest payment made by a bond issuer to its bondholders, expressed as a percentage of the bond’s face value. Conversely, the interest rate is the cost of borrowing or the return on investment, expressed as a percentage of the principal amount. While the coupon rate remains fixed for the duration of a bond, the interest rate can fluctuate based on economic conditions and monetary policy.

Focusing on these distinctions helps investors evaluate bonds, comprehend the risks and returns associated with different financial products, and navigate the complexities of the investment landscape. The coupon rate directly influences a bond’s yield and its appeal to investors, whereas interest rates affect overall borrowing costs and the attractiveness of saving or investing in various financial instruments.

Key Concepts

Financial Rates Overview

Before diving into the specifics of coupon and interest rates, it’s essential to grasp their role in the financial landscape. At their core, these rates serve as tools for measuring the cost of money, whether it’s the price of borrowing funds or the earnings from lending or investing money. They’re foundational to the decision-making process in investments, savings, and loans, affecting everything from government bonds to personal savings accounts.

Definition of Interest Rates

Interest rates signify the cost of borrowing money or the reward for saving money, expressed as a percentage of the principal amount. Central banks set benchmark interest rates that influence various financial products and services. The dynamics of interest rates are pivotal, as they have a domino effect on the economy, influencing spending, inflation, and overall economic growth.

Definition of Coupon Rates

On the other hand, the coupon rate is specific to bonds and similar debt securities. It represents the annual interest payment to bondholders, based on the bond’s face value. The term “coupon” dates back to when physical bond certificates included coupons that holders would redeem for interest payments. Today, while bonds are primarily electronic, the concept remains unchanged.

Coupon Rate Explained

Basics of Coupon Rate

Meaning and Calculation

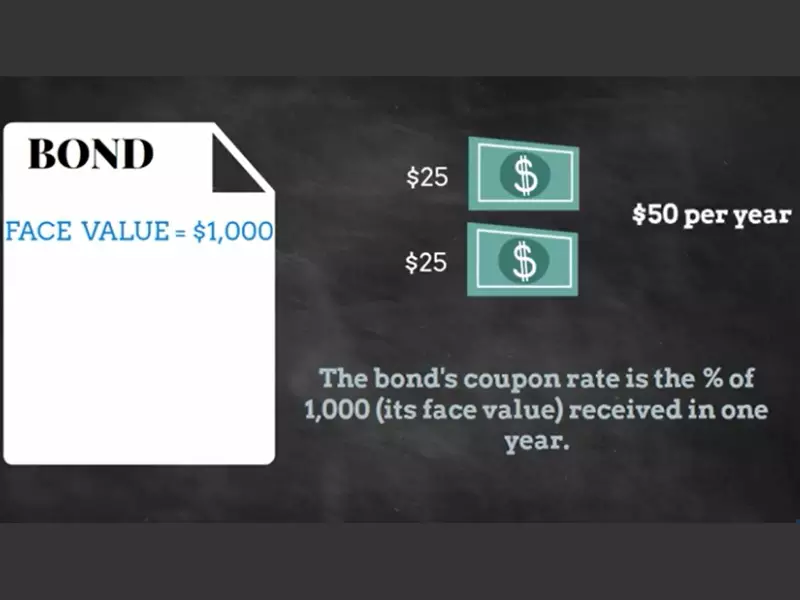

The coupon rate is a fixed percentage of the bond’s face value that the issuer agrees to pay annually or semi-annually to the bondholder. It is calculated by dividing the total annual interest payments by the bond’s face value. For example, a bond with a face value of $1,000 and annual interest payments of $50 has a coupon rate of 5%.

Role in Bonds

The coupon rate is a critical factor in determining a bond’s yield and its market value. Bonds are typically issued with coupon rates that are comparable to the prevailing market interest rates. If market interest rates rise, the value of existing bonds with lower coupon rates may decrease, as newer bonds might offer higher returns.

Fixed vs. Variable Rates

Types of Coupon Rates

Bonds can have either fixed or variable coupon rates. Fixed coupon rates do not change throughout the life of the bond, offering predictability to investors. Variable or floating coupon rates, however, adjust at regular intervals, usually in relation to an index or benchmark rate. This can make them more attractive during periods of rising interest rates.

Interest Rate Explained

Understanding Interest Rate

Meaning and How It’s Determined

Interest rates are influenced by several factors, including central bank policies, inflation, and the demand for and supply of credit. Central banks, like the Federal Reserve in the United States, adjust benchmark interest rates to control economic growth and inflation. These rates then influence the interest rates that banks charge each other and their customers.

Types of Interest Rates

Interest rates come in various forms, including the prime rate, discount rate, and federal funds rate. The prime rate is the rate banks charge their most creditworthy customers, often used as a benchmark for various loans. The discount rate is the interest rate central banks charge commercial banks for short-term loans. The federal funds rate is the target interest rate at which banks lend and borrow excess reserves overnight from one another.

Impact on Economy

Influence on Loans and Savings

Interest rates have a profound impact on consumer behavior and economic health. Lower interest rates make borrowing cheaper, encouraging spending and investment but potentially reducing the attractiveness of saving. Conversely, higher interest rates can dampen spending and borrowing but encourage savings, as the returns on deposits and savings accounts improve.

Comparing Coupon and Interest Rates

Understanding the distinction between coupon rates and interest rates is crucial for navigating the financial landscape. These concepts, while related, serve different functions in the world of finance and have unique implications for investors, borrowers, and the economy as a whole.

Fundamental Differences

Comparison of Definitions and Applications

At the most basic level, the coupon rate applies specifically to bonds and is the interest payment made to bondholders, based on the bond’s face value. It is fixed for the life of the bond. Interest rates, however, are broader in scope, influencing the cost of borrowing across various financial products, from loans to savings accounts, and can vary over time.

Influence on Investment Decisions

The choice between investing in a bond with a specific coupon rate or opting for an investment influenced by fluctuating interest rates can significantly impact an investor’s strategy. High coupon rates can make bonds attractive during periods of low interest rates, while rising interest rates may lead investors to favor variable-rate investments.

Impact on Bond Valuation

Calculating bond prices is a complex process influenced by both the coupon rate and prevailing interest rates. A bond’s price moves inversely to changes in interest rates; if interest rates rise, the price of existing bonds with lower coupon rates typically falls, and vice versa.

Factors Affecting Rates

Economic Indicators

Economic health, indicated by GDP growth, inflation, and employment rates, directly affects interest rates. Central banks might raise rates to cool an overheating economy or lower them to stimulate growth. These macroeconomic factors do not directly change coupon rates but influence the market’s interest rate environment.

Central Bank Policies

Interest rate decisions and monetary policy are tools used by central banks to manage economic stability. Policy changes can alter the landscape for both coupon and interest rates, affecting everything from the attractiveness of new bond issues to the cost of borrowing for consumers and businesses.

Market Dynamics

The supply and demand in bond markets can shift bond prices and indirectly affect the effective yield or interest rate investors receive. High demand for bonds with attractive coupon rates can drive up prices, lowering the yield for new investors despite the fixed coupon rate.

Real-World Implications

For Individual Investors

Strategies Based on Rate Analysis

Investors must adjust their strategies in response to changes in interest rates and the fixed nature of coupon rates. This might include:

- Diversifying between fixed and variable rate investments to balance risk and return.

- Timing bond purchases to capitalize on interest rate trends.

- Considering bonds with different maturities to manage interest rate risk.

For Corporations

Decision-making in Bond Issuance

Companies looking to issue bonds must carefully consider the coupon rate to offer. Setting a rate too low might result in insufficient demand, while a rate too high can unnecessarily increase borrowing costs. The decision often hinges on current interest rates and market expectations.

For the Economy

Overall Impact of Rate Changes

Changes in both coupon rates (through new bond issues) and interest rates can have widespread effects on the economy. For example, lower interest rates can stimulate borrowing and spending, leading to economic growth. However, if rates are too low for too long, they may fuel inflation. Conversely, higher rates can slow economic activity but help control inflation.

Frequently Asked Questions

What is a Coupon Rate?

The coupon rate is the annual interest yield of a bond, based on its face value. It’s a fixed percentage that determines the regular income an investor can expect from holding the bond, regardless of market changes. This rate is set at the issuance of the bond and remains constant, serving as a key factor in the bond’s overall return.

How is Interest Rate Different?

Interest rate, broadly, refers to the cost of borrowing money or the return on investment for savings and loans. It varies over time, influenced by central bank policies, economic conditions, and market demand. Unlike the fixed coupon rate, interest rates can fluctuate, impacting everything from mortgage rates to the interest earned on savings accounts.

Why Do These Rates Matter to Investors?

These rates are crucial for investors as they determine the potential return on investments and the cost of borrowing. A higher coupon rate means more income from bonds, while lower interest rates can make borrowing cheaper and saving less attractive. Understanding these rates enables investors to make strategic decisions, balancing risk and reward effectively.

Can Interest Rates Affect Coupon Rates?

While the coupon rate of a bond is fixed after issuance, prevailing interest rates at the time of the bond’s issue can influence its coupon rate. Issuers set coupon rates based on comparative interest rates to make their bonds attractive to investors. However, once issued, a bond’s coupon rate does not change with fluctuations in interest rates.

Conclusion

Grasping the difference between the coupon rate and the interest rate is paramount for anyone involved in the financial markets. These rates not only influence investment returns and borrowing costs but also reflect broader economic conditions. By understanding how each rate functions and impacts financial decisions, individuals can better navigate the complexities of investing and borrowing, making informed choices that align with their financial goals.

In essence, while the coupon rate and interest rate serve different purposes, both are integral to the fabric of the financial world. Recognizing their roles and differences empowers investors and borrowers alike, fostering a more robust understanding of financial mechanisms and contributing to more strategic financial planning and analysis.